New Releases in this Update

| Update ID | Type | Title | Functional Area |

|---|---|---|---|

| PE-236 | Enhancement | Tax & Retention Calculation based on "option 2 of A/R retention calculation method" under Retention on Job Setup |

ProjectPro Basics |

| PE-263 | Enhancement | JFW: Remove "Job Forecast Worksheet Report" from Global Search |

Job Forecast Worksheet |

| PRJCTPR-322 | Enhancement | Removal of Resource Group from Job Planning Lines under Type selection. |

ProjectPro Basics |

| PRJCTPR-325 | Hot Fix | JFW: Forecast Override not updating values on existing JFW |

Job Forecast Worksheet |

Release Note Details

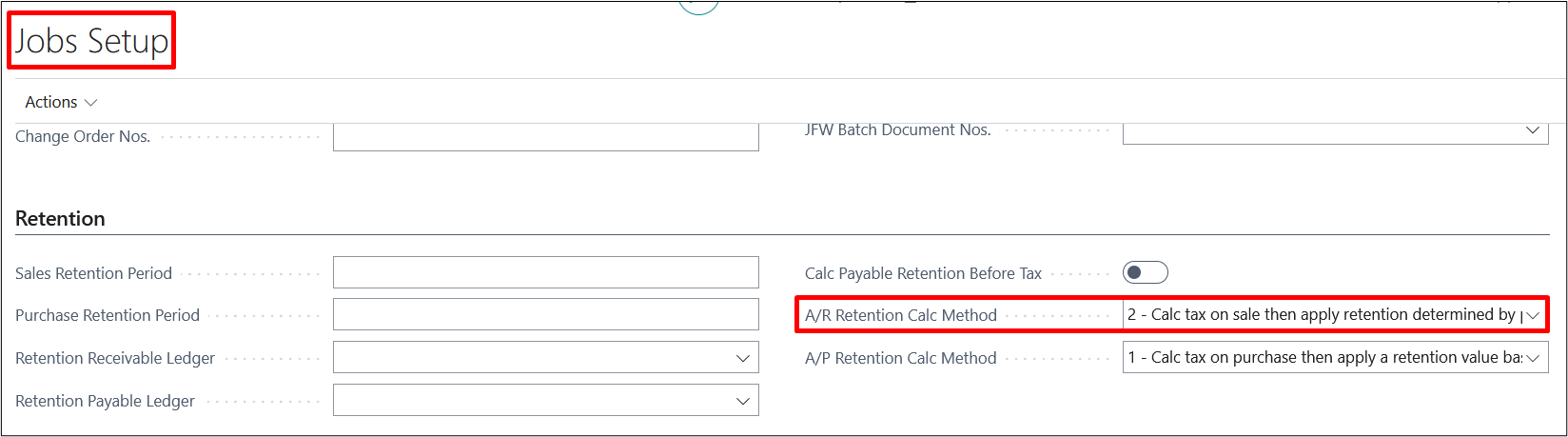

PE-236

Enhancement- Tax & Retention Calculation based on "option 2 of A/R retention calculation method" under Retention on Job Setup

Under Option 2, The tax is calculated on the Billed Amount and then Retention is deducted from it. So, the Amount Receivable will be “Billed Amount + Tax – Retention”.

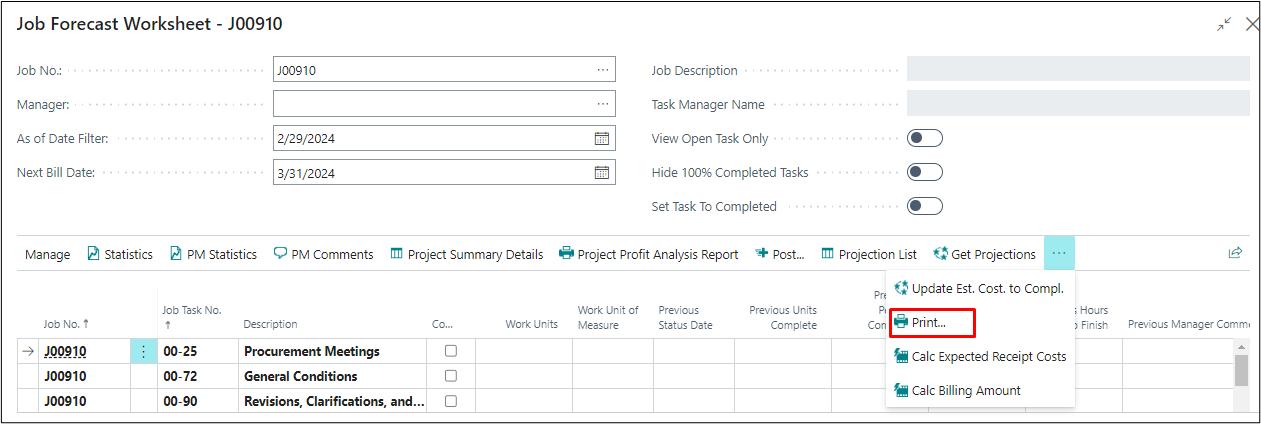

PE-263

Enhancement- JFW: Remove "Job Forecast Worksheet Report" from Global Search.

Job Forecast Worksheet report has been removed from the global search. This report can only be printed from the Job Forecast Worksheet’s “Print” option.

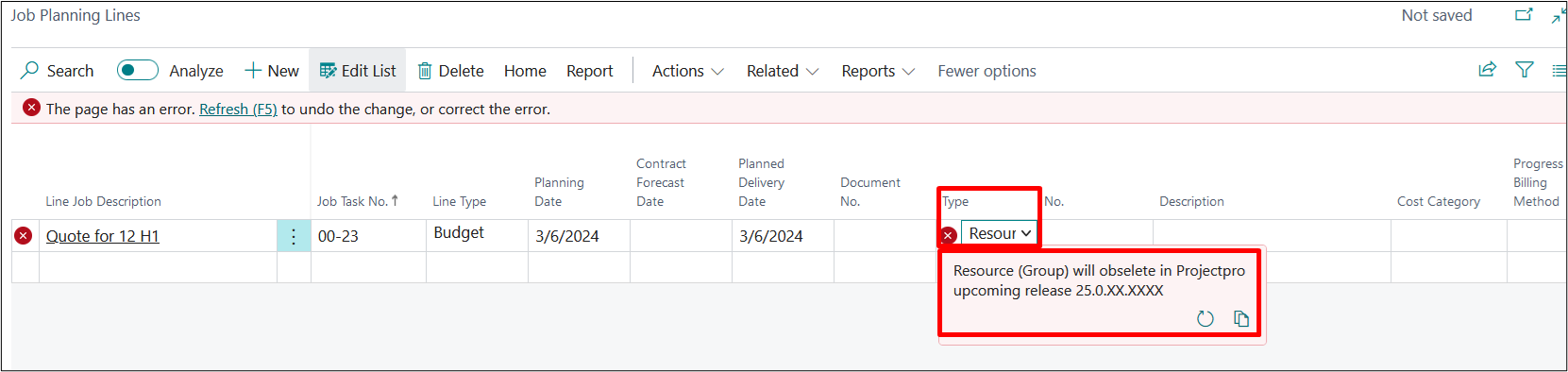

PRJCTPR-322

Enhancement- Removal of Resource Group from Job Planning Lines under Type selection.

The “Resource Group” option under Type field on Job Planning Lines has been removed for future.

PRJCTPR-325

The condition to update “Override Forecasted Completed Cost” values only on the new forecast has been removed and going forward, the values added under this column on Job Task Lines, will flow directly to JFW against the corresponding task line.

The condition to update “Override Forecasted Completed Cost” values only on the new forecast has been removed and going forward, the values added under this column on Job Task Lines, will flow directly to JFW against the corresponding task line.