The CARES Act & the Construction Sector

Seeking Aid, Relief, and Economic Security Amidst COVID-19

The outbreak of novel coronavirus has emerged as a disaster that will mark its place in history. It has not only affected the health and economic status across the Globe but has shaken the roots of every business irrespective of the industry. From the scarcity of the resources to the loss of liquidity, the impacts are unprecedented and the construction industry is no exception to them.

Along with the fear, anxiety, and stress which are building due to the uncertainty of the situation, the construction giants are concerned about recovery in the course of extreme situations.

The CARES Act

As a part of risk management planning, it is essential to work on challenges that may bring any loss to business and find measures to deal with them. Consider the recent CARES Act released March 27, 2020, it offers a clear picture to the relief and opportunities which would be available to the various industries after the end of the pandemic, if not restricted to construction.

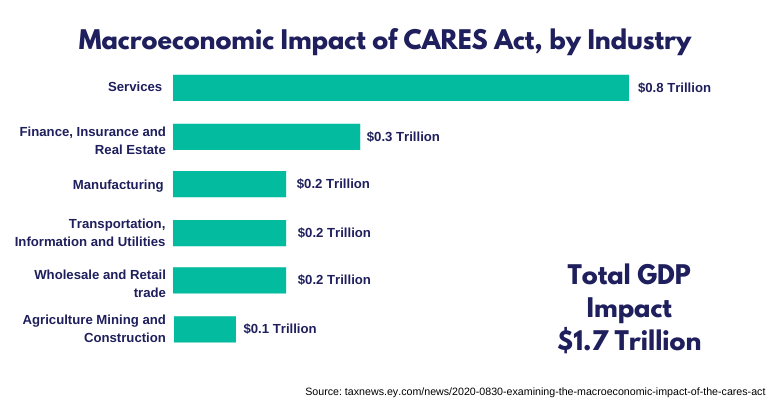

Besides all, the CARES Act is the largest relief package introduced by the Government in the history of the United States which is likely to combat the economic rupture through $2 trillion.

Besides all, the CARES Act is the largest relief package introduced by the Government in the history of the United States which is likely to combat the economic rupture through $2 trillion.

Though there are no specific guidelines or orders made in context to the construction industry, the construction firms such as small or mid-sized businesses could still work on risk planning through capitalization benefits.

However, the benefits are only restricted to the firms who will qualify the guidelines and terms of the Cares act. This would simply require construction firms to be active on the use of accounting software for construction firms to keep track of all expenses related to capital, labor, and loss.

Moreover, the CARES Act could also help construction firms to reap benefits with funding that can help combat COVID-19 and sustaining the health-specific infrastructure. In simple words, it is all about locating opportunities that can put forward the construction business and help the country progress during and after COVID-19.

What Comprises the CARES Act?

The Relief

To combat the economic impact of COVID-19, CARES Act was released as the third installment of the Federal Stimulus Package. The CARES Act not only looks for medical expenditures but also includes:

- Convenient small business loans

- Unemployment benefits with eligibility expansion

- Direct loans to large business, as well as tax credits on the payroll

- Direct rebate on taxes i.e. improved individual benefits

Benefits for Construction Industry

The CARES Act provides relief to small construction companies and contractors who need financial aid. With the Paycheck Protection Program, every small construction firm could seek support on retaining employees through short term capital.

Moreover, the CARES Act has a provision to defer payroll taxes for the year 2020 as the due amount could be paid in two installments, one in 2021 and other in 2022. This can be of great benefit and help to construction firms who were forced to close as they made up to non-essential services.

Also, it provisions these construction firms to have Employee Retention Credit which would include credits equals to 50 percent of employee wages paid, considering the maximum credit for an employee to be $5000.

Eligibility: How does that work?

The eligible lenders would be selected by SBA (Small Business Administration) on qualifying the eligibility criteria i.e. to have a workforce of 500 employees or as decided by SBA. For those eligible, the loan could expand to 250 percent of business for payroll costs of around $10 million. Moreover, the loan amount could be forgiven, if the first spend is made on business payroll, mortgage interest, and essential utilities, followed by maintenance of payroll.

Loan Forgiveness

The loan forgiveness scheme under the Paycheck Protection Program for Small Business has its criteria on forgiving loans. The loan payments will also be deferred for 6 months. Moreover, it does not require the applicant to submit any collateral or guarantee nor any fees would be charged from the applicant by the lender or government.

With a maturity rate of 2 years and an interest rate of 1 percent, the loan forgiveness would be applicable for the employer who sustains or rehire the employees quickly and maintain their salary levels as well. For those who will have reduced salaries or wages tend to face a decrease in forgiveness level.

Aid for Construction Workers

The CARES Act has been designed to provide relief for workers or skilled labor that are working or were laid off.

Some of the features include:

Tax Rebate: Though most people are familiar with this, under this, the direct rebate is provided to the individuals, which is $1200 for every individual is making less than $75,000 a year. However, married couples with an income of less than $150,000 in 2019 are likely to receive $2400. Moreover, for those having a child will get $500 per child.

401(k) Benefits: For those who are affected by the pandemic, the CARES Act introduces suspension of 10 percent penalty withdrawal for early retirement distributions up to $100k. Moreover, people who are eligible 401(k) could borrow $100k or even 100 percent of their vested account under the retirement plan. But still, the benefits are only restricted to those who are considered eligible for the benefit by the law.

Benefits to the Employees who were Laid Off

Though each state will have a different structure for the unemployment insurance scheme, the CARES Act was released with expanded benefits on unemployment. For those construction companies who need to lay off, their employees could simply help their employees get the advantage of unemployment insurance. Some of the benefits that come with unemployment insurance include:

Increased Timeframe: the government has increased the timeframe of unemployment benefits from 26 weeks to 39 weeks, which means the affected individuals could take benefit from the scheme throughout 2020.

Waiver over Waiting Period: The CARES Act has provided a waiver over typical one-week waiting time on unemployment benefits.

Added Stipend: Along with State benefits, the unemployed workers will get an extra $600 per week. For most states, it has been decided to deliver a standard benefit of 50 percent of worker’s past weekly wages.

Eligibility Criteria: The eligibility criteria, as decided by the Government for the unemployment benefits, under the CARES Act, consist of:

- Those who were diagnosed or quarantined due to COVID-19

- Those who were looking after a family member with COVID-19

- Those who were scheduled to work but were unable to join due to COVID-19

- Who was forced to quit or terminated because of COVID-19

- No work as a place of employment is closed.

What does the CARES Act mean to Construction Industry?

Let us now take a closer look at how the CARES Act could contribute to construction firms and help them navigate for recovery opportunities.

Payroll Assistance & Tax Relief

One of the primary goals for which the CARES Act has been released is to help provide relief to all the small businesses. This is because of the fact that most small businesses in the United States tend to have inadequate plans or insurance policies that can help them cover the loss during the COVID-19. Moreover, it will also be a benefit for those who need support or back up to get their business back on track and move forward once the crisis is over.

Most of the relief comes through the Small Business Administration’s forgivable loans worth $349 billion. This has been made possible through the Paycheck Protection Program, an initiative that allows support of $10 million to small businesses with employee strength of fewer than 500 employees as per the Small Business Act.

This could help small firms with business expenses related to payrolls, including paid medical or family leave or any costs related to group health care policies. Moreover, it could be leveraged to an advantage for mortgage payments, rent, utilities, and clearing any outstanding dues. Also, the loans could be leveraged to an advantage for independent contractors as well as self-employed proprietors.

Apart from this, the construction firms which continued paying the staff throughout the crisis will get loan forgiveness for all payments made in favor of payrolls including the interest on rent, mortgage, and other obligations. However, it would be a smarter move on the part of the construction companies to have all their data and records streamlined taking the advantage of construction accounting ERP software.

This is being done with the purpose to offset liabilities and will help construction firms get over the taxes associated with payrolls. Moreover, construction firms that are struggling to manage the operations during COVID-19, the act will ensure necessary support on recovery efforts and planning.

Funding Opportunities

Since there is complete uncertainty about when the restrictions related to construction practices will end, it has become very difficult for construction firms to have any idea of the expected delay with the projects.

Considering the situation, the CARES Act has provisions that allow construction firms with federal funds required for the new construction. Therefore, planning for the opportunities with the CARES Act could be the hope the construction industry is looking for.

Moreover, the allotment of over $27 billion to the Department of Labor for public health and Social Services Emergency Fund will be a major benefit to seek. This is because of these benefits which will help the construction firms to respond to COVID-19 and ensure support for construction projects set up to improve manufacturing facilities.

This also implements for the manufacturing units working on diagnostic, vaccination, testing equipment, and compensating healthcare firms for all the construction made in response to the COVID-19 care plan.

However, to seek maximum benefit from the CARES Act, construction firms and other employers must involve their legal and tax advisors. Also, the firms could take benefit of tools like construction accounting software to keep track of all resources and data. It will help in understanding the right process to access federal funds and meet the requirements for qualifying the list of beneficiary groups.

Also, taking the advice of experts on understanding the risks will help to gain an idea of business disruptions and create a master recovery plan for getting over the losses with smooth revival.

.jpg)