Simplifying The Task Of Construction Payroll Management Using ProjectPro

When it comes to expenses in construction, the maximum amount of project budget and expenses are covered by Payroll. However, most contractors and construction firms tend to struggle when it comes to managing payroll data with efficiency.

Especially, when project managers need to deal with routine tracking of the labor data, the wage hours, and overtime, it often gets complicated to work on paperwork or using excel sheets to process the payments to the workers.

Since it is crucial for every contractor to work on the payroll process with precision, using a construction accounting software like ProjectPro can be the ultimate help you need to bring consistency with your finances and avoid any over expenses.

Here we bring you a quick list of 5 payroll features that are offered by ProjectPro and can help you overcome the entire headache of managing payroll data in routine. Let’s begin.

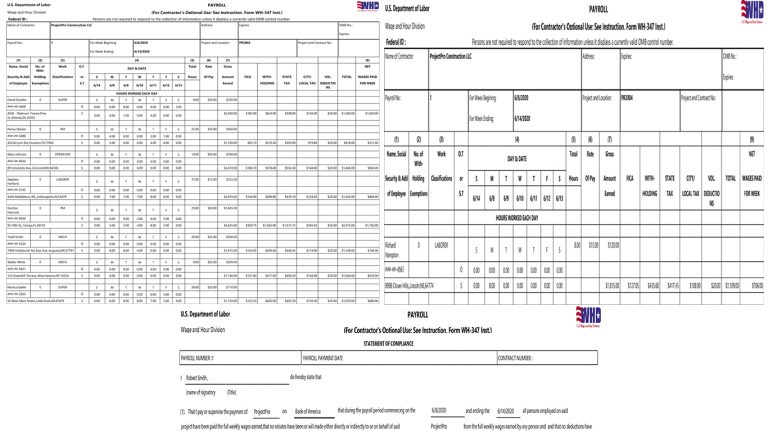

Certified Payroll

Most contractors who wanted to work on Federal projects or are already working on them had to be prepared with payroll guidelines defined by the Government agencies involved i.e. Certified Payroll Reports.

Since certified payroll reports need to contain complete detail of the prevailing wage along with the statement of compliance, working on payroll gets tricky for federal funded projects. However, ProjectPro helps you work on things correctly and in a timely manner. It even lets you automate the entire task of making entries for the wage hours while processing the tax amounts that are provided.

Easy Deposit

ProjectPro allows easy deposits when it comes to payroll which makes it a complete construction accounting software that you need to keep a check on your finances. Since the manual task of printing checks and making payments can be consuming, using software is always a better idea to make quicker payments.

Moreover, an automated system used to process invoices, bills, and payments allow contractors and project managers to retain cash flow with faster payments. This helps to improve the payment receiving process and equally improves the disbursements that are made in context to the payroll process.

Support For Multiple States, Cities, And Counties

For big contractors or firms who need to work across different parts of the country, payroll reporting can be a task. Since every state, city, or county has its own rules when it comes to wage taxes and payroll, contractors often struggle to work on different tax rates. Especially, when states like Massachusetts have their special taxes like PFMLA, the task becomes even tougher.

Since construction projects have different employees under various trade classifications, defining pay rates through a conventional paycheck system could be difficult. ProjectPro allows you to define taxes and trade classifications for all the employees to ensure that all the state and federal tax laws must be followed. In simple words, if you need to assign different pay rates and different tax rates to employees based on their category of work, ProjectPro lets you process payroll in a hassle-free manner.

Standard and Custom Reports

Another good thing that makes ProjectPro a perfect companion for all your payroll reporting goals is the ease with which it can work on standard reports. Either it is about year-end W-2s or detailed payroll tax reports for federal or state reports.

Also, if you need to work on custom reports for your Payroll data, even then ProjectPro can help you customize reports. When you need to track your project expenses or identify how much of your budget is going into the payroll, custom reports on ProjectPro gives you the ability to learn about all your expenses.

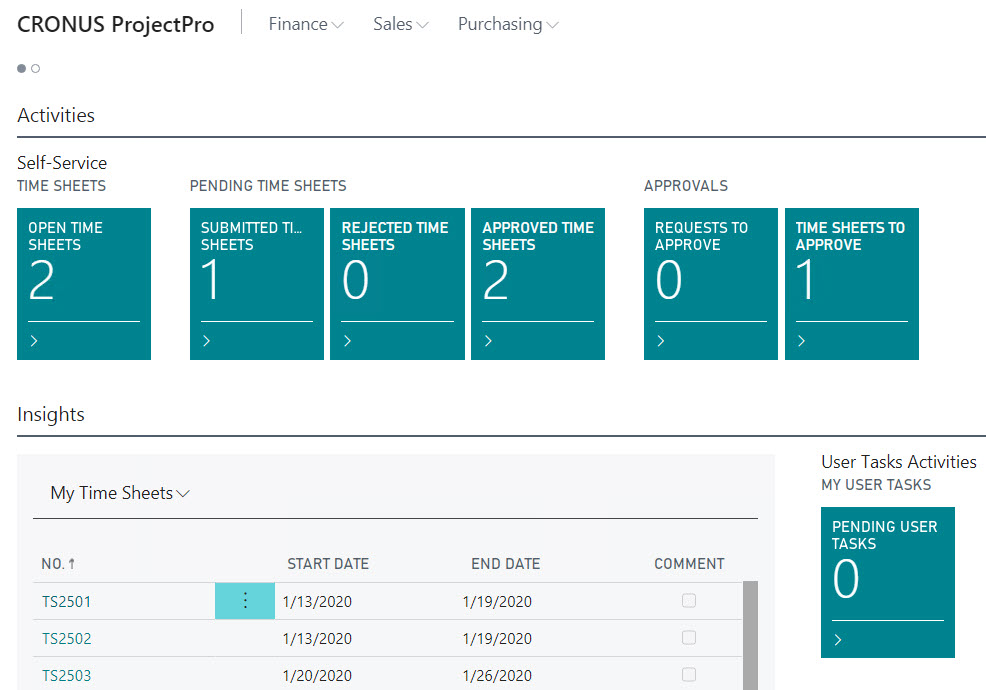

Time Collection

Last but not least, ProjectPro brings you the advantage of recording work hours on Timesheets when it comes to your Payroll data. Originally designed as construction accounting software, its integrated nature brings you all the qualities of construction project management software.

Last but not least, ProjectPro brings you the advantage of recording work hours on Timesheets when it comes to your Payroll data. Originally designed as construction accounting software, its integrated nature brings you all the qualities of construction project management software.

Timesheets allow you to have a fast and efficient collection of time, no matter it is a small project with 100 people or a large-sized project with a site staff of 500. Previously, it was considered as the job of the foreman to ensure that everyone at the site is at work and is allocated the right task.

However, the advanced construction needs have shifted this to technology like ProjectPro, and it has become a much convenient task that can even be managed from remote locations using your mobile device. Since it does not involve any paperwork or error data shared through excel sheets, you can quickly take your information to payroll processing saving time at the field as well as office.

The Crux

When it comes to the most crucial processes like payroll reporting for your construction business, it is necessary to understand what your business needs and what technology can help you work over construction payroll process challenges.

Since investing in construction accounting software along with other separate solutions for project management and ERP can make things more complicated, it is always a better plan to choose an integrated construction accounting software like ProjectPro.

Either it is about creating an employee database, automating post-labor or job costs, track vacations, leaves, ProjectPro can handle all these tasks with ease. Moreover, when you need to work on taxes and deductions for layoff checks, align with provisions like Davis-Bacon and Section 125 deductions, it allows you to automate everything from printing garnishment checks following the state tax while giving you support on creating custom union reports.

If you are looking for a construction accounting software that can help you get over all construction payroll problems and solutions, try ProjectPro, an integrated technology designed to simplify all your tasks related to construction management.

To learn how ProjectPro works on the payroll process in detail, consider scheduling a free demo today.

.jpg)